FBR Pakistan issue a unique identity to each taxpayer or legal entity in Pakistan which is known as National Tax Number, FBR Pakistan introduce an easy online NTN Verification search engine for taxpayers Online NTN inquiry, FBR NTN Verification. How to verify NTN online or How to verify NTN Number in Pakistan the solution of this query is made so easy by FBR Where any individual can online NTN number Check. By using the following instructions.

FREE NTN REGISTRATION FBR

Setup a free account & File Your Free NTN Registration FBR request with us. Get your NTN with in 1-2 working days. You can also use it to file your FBR Tax Returns.

In order how to verify the NTN number in Pakistan, you have to follow the simple sets. Please use the quest bar beneath for online NTN Verification and click within Online Services on ONLINE VERIFICATION PORTAL.

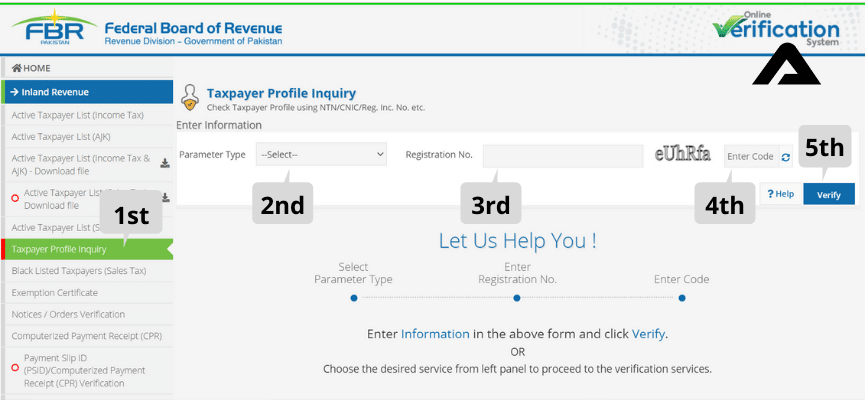

How Can I Check FBR – Taxpayer Profile?

Provide your respective “Registration No” in the registration field. (This is a number that you received when you submitted your request to get a National Taxation Number.)

- 1st Step: To check the detail of the individual, AOP, or Company in the records of FBR according to NTN number in Pakistan, click on the “TaxPayer Profile Inquiry” option from the left sidebar.

- 2nd Step: Select between defined parameter CNIC / NTN / INC No.

- 3rd Step: Enter your “CNIC” in the REG # field.

- 4th Step: Enter the captcha against the “Captcha” field.

- 5th Step: By clicking on the “Submit” button information will display on the screen.

Now Follow the above instruction in the below image.

FBR Taxpayer Profile Inquiry helps you in external verification or confirmation of taxpayers’ profiles in Pakistan. Which describes a couple of things about taxpayers Like Registration Number / CNIC, Reference Number / NTN, Registered For Sales Tax, Category, Personal Details, Date of Registration, correspondence RTO, and Business Details mentioned in the Column.

What Is The Meaning Of Filer or Non-Filer?

Taxpayers profile inquiry just only confirm your registration with FBR Pakistan but this verification doesn’t confirm that you or a particular taxpayer is a filer or non-filer, FBR Pakistan updates the list Active Taxpayers List at the start of March of each year on the basis of the previous year tax return and mark those individuals as Filer who file the last return within the deadline, Similarly mark those individuals as Non-Filer who didn’t file the last return within the deadline.

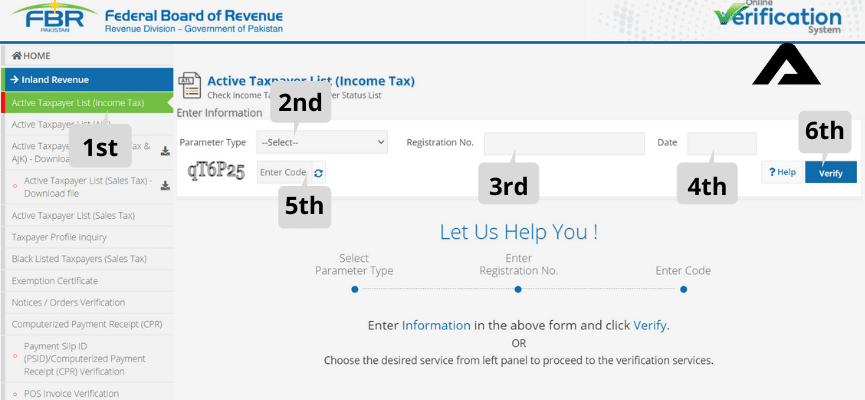

How Can I Check FBR – Filer or Non-Filer?

Provide your respective “Registration No” in the registration field. (This is a number that you received when you submitted your request to get a National Taxation Number.)

- 1st Step: To verify the status of an individual, AOP, or Company as Filer or Non-filer in the records of FBR according to NTN number in Pakistan, click on the “Active TaxPayer List” option from the left sidebar.

- 2nd Step: Select between defined parameter CNIC / NTN / INC No.

- 3rd Step: Enter your “CNIC” in the REG # field.

- 4th Step: Select the date in the “DATE” field.

- 5th Step: Enter the captcha against the “Captcha” field.

- 6th Step: By clicking on the “Submit” button information will display on the screen.

Now Follow the above instruction in the below image.

This ATL external inquiry helps to confirm that you or a particular taxpayer has filed the tax returns within the deadline and holds an active tax filer status. In case, the report shows INACTIVE which means you or a particular taxpayer has not filed tax returns within the deadline and is subject to penalization under section 182 income tax ordinance 2001 of Pakistan. People in developed Societies pay taxes. You should also read the Benefits for Filler section articles. Which describes well the benefits of being a responsible resident of Pakistan.